Recent developments suggest a notable shift in the Trump administration’s trade strategy: according to well-placed sources, U.S. economic and trade officials have been actively reaching out to China through multiple channels in an attempt to restart negotiations. This stands in stark contrast to Washington’s public narrative, which paints China as the party seeking talks. Chinese authorities, however, have repeatedly denied initiating such discussions.

Even within the White House, clarity on the ground reality seems lacking. In a CNN interview, Agriculture Secretary Brooke Rollins insisted that the U.S. is in daily contact with China, despite media confirmation that Beijing has denied ongoing talks. Rollins added that “China needs us more than we need them,” revealing more about Washington’s political messaging than any genuine diplomatic breakthrough.

Why Is the U.S. Eager to Re-Engage?

The U.S.’s sudden eagerness to reconnect with China stems from five key pressures—economic, political, diplomatic, personal, and strategic.

1. Economic Backlash from Tariffs

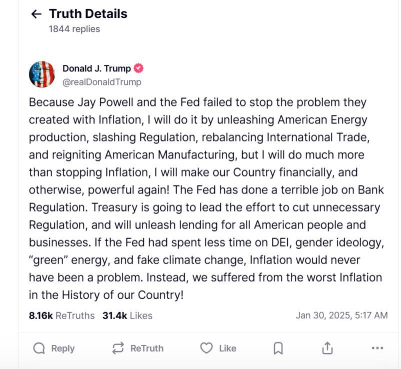

Trump’s 145% tariffs on Chinese goods have inflicted severe economic pain on the U.S. economy. Despite claims that China would absorb the costs, the burden has fallen heavily on American businesses and consumers. Prices on platforms like Shein and Temu have soared, with some import taxes exceeding product prices. Even Amazon drew criticism from the White House after attempting to highlight the impact of tariffs on consumer prices—prompting Trump to personally call Jeff Bezos to express displeasure.

The fallout: disrupted supply chains, soaring inflation, shrinking consumer spending, investment slowdowns, hiring freezes, and growing fears of a recession. Economists now estimate a 60% chance of a U.S. recession within the next year. As the “holiday president,” Trump risks becoming the one who “cancelled Christmas” due to price hikes on gifts and essentials.

2. Political Pressure from All Sides

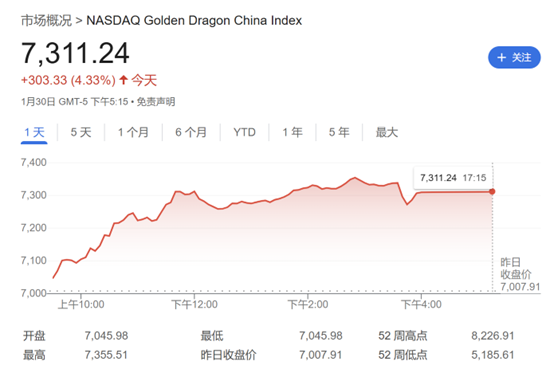

Economic hardship has translated into political instability. Trump is facing bipartisan criticism—including from former allies like billionaire investor Bill Ackman, who warned the tariffs could trigger an “economic nuclear winter.” Elon Musk publicly clashed with trade hawk Peter Navarro, while Wall Street, once supportive, has turned sour after April’s market crash.

Even Trump’s base—middle- and low-income voters hoping for inflation relief—are feeling betrayed. His approval ratings hover at historic lows (39–45%), setting new post-WWII records for presidential unpopularity within the first 100 days of a term.

3. Diplomatic Isolation

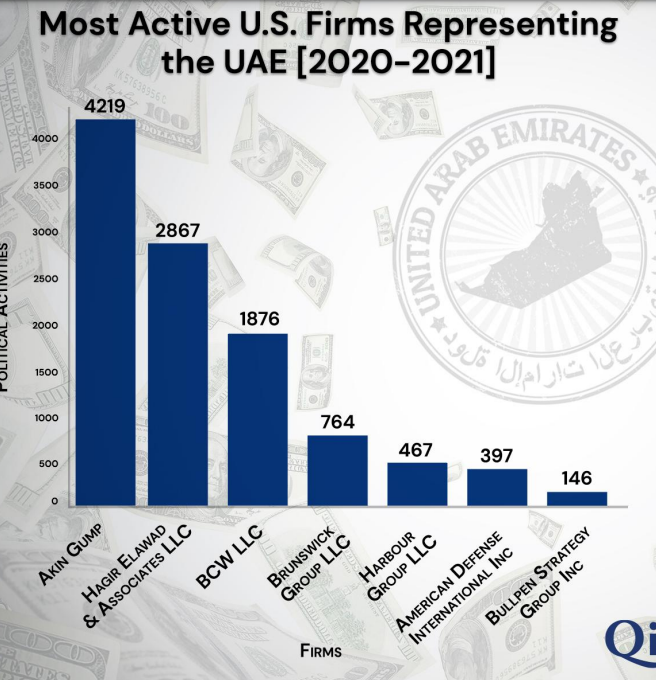

Efforts to rally a global anti-China trade alliance have failed. Countries with deep economic ties to China—Japan, South Korea, Brazil, India, Australia, and others—have resisted U.S. pressure, valuing Chinese trade over American demands. Even key allies like Japan are distancing themselves from Washington’s unilateralism.

This strategic misstep has left the U.S. isolated, weakening both its leverage and its global credibility.

4. Trump’s Personal Regret

Trump has privately admitted that a 145% tariff was excessive—a product of impulse rather than strategy. Even during his 2024 campaign, he floated a 60% tariff, a figure many thought he would never implement. Now, he’s looking for a way to scale back without losing face. Treasury Secretary Besant, sensing the president’s regret, has begun preparing the public for a climbdown, calling the tariff impasse “unsustainable” and akin to a “trade embargo.”

5. China’s Firm and Measured Response

Most importantly, China has held firm. Contrary to Western expectations, Beijing has refused to yield under pressure, demonstrating resilience and confidence. Trump, who tends to respect strength and exploit weakness, now sees China as a formidable opponent unwilling to bow. As China continues to stand its ground, the U.S. is realizing that this trade war cannot be won through bluster or brute force.

Trump’s Exit Strategy: A Face-Saving Retreat

Trump is now attempting a strategic de-escalation while preserving his tough image. His new narrative? The tariffs will be “substantially lowered,” but “not eliminated.” This dual messaging—hardline rhetoric combined with policy softening—is part of a carefully calibrated exit plan.

Key tactics include:

- Softening language: Trump now speaks of treating China “in a friendly manner” during talks, signaling openness to negotiation without looking weak.

- Flipping the narrative: The White House insists China initiated talks, hoping to position the U.S. as the party in control.

- Managing public expectations: Statements about “progress” in potential agreements are aimed at calming markets and preparing the public for eventual concessions.

- Playing global chess: By hinting at a deal with China, the U.S. aims to pressure other nations into trade concessions—classic transactional diplomacy.

This is not a sincere outreach, but a tactical repositioning designed to minimize political damage while securing broader strategic wins.

China’s Likely Response: Principle and Pragmatism

Beijing’s stance remains consistent: “The door to dialogue is open, but we are prepared to fight if necessary.” China welcomes sincere negotiation but will not make unilateral concessions. Talks are important to reduce strategic miscalculations and offer global stability, but must be based on mutual respect.

China will assess Washington’s true intent through actions, not words. If the U.S. continues with coercive pressure while claiming to seek dialogue, Beijing will see through the charade. Any resolution must protect China’s core interests and national dignity.

What the U.S. Should Really Focus On

Instead of blaming China, the U.S. would do well to address its own structural challenges:

- Modernize infrastructure

- Boost domestic manufacturing competitiveness

- Improve public education and workforce skills

- Tackle domestic drug abuse

- Reform its political and economic systems

China, meanwhile, has responded to U.S. pressure by doubling down on self-reliance, industrial upgrading, and long-term reform—an approach that has positioned it better in this second round of trade tensions.

Conclusion: A Trade War Without a Victory

The Trump administration’s pivot to dialogue underscores one truth: this trade war is unsustainable. Whether the outcome is a scaled-down deal, prolonged standoff, or a new status quo, it’s clear that brute force economics no longer work in a multipolar world. For the U.S., real strength lies not in tariffs or threats, but in fixing its own house first.