1. The Federal Reserve Holds Steady on Interest Rates

During a congressional hearing last night, Federal Reserve Chair Jerome Powell stated that the U.S. economy is in good shape and that current interest rate levels are appropriate. He noted that there is no urgent need for further rate cuts. Given that the Fed has already lowered rates three times last year by a total of 100 basis points, the market now expects that this phase of rate cuts has ended, making another cut in March unlikely.

2. Mixed Performance in U.S. Markets, but Hong Kong Stocks Continue to Rise

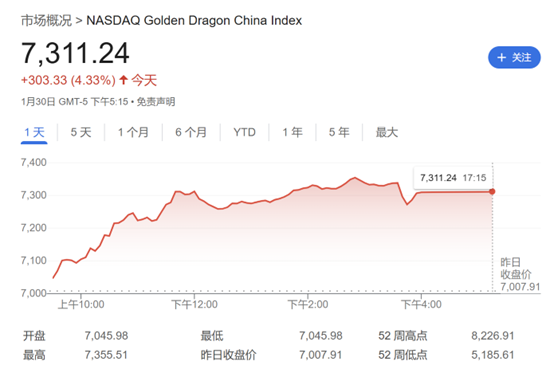

U.S. stocks showed a mixed performance overnight, with overall momentum appearing weak. This followed a minor pullback in the Hong Kong market yesterday, where stocks briefly dipped to test the five-day moving average. As a result, the index tracking U.S.-listed Chinese stocks fell by 1.77%.

However, Hong Kong’s Hang Seng Index rebounded strongly today, opening 1.09% higher and continuing to climb throughout the morning, at one point gaining over 2%. Since January 14, the Hang Seng Index has surged by more than 14%.

3. A-Shares Remain in a Consolidation Phase

In the A-share market, technology stocks continued to lead, but overall trading remained within a narrow range. The Shanghai Composite Index initially moved higher but later retreated, closing the morning session at 3,317 points, down slightly by 0.01%. The Shenzhen Component Index, ChiNext Index, and STAR Market Index saw modest gains of 0.07%, 0.09%, and 0.36%, respectively, reflecting a largely stable market trend.

4. Market Liquidity Remains Strong

Trading activity remained high, with total turnover in the two mainland stock exchanges reaching 999.9 billion yuan by midday—only slightly lower than the previous day. While the broader market remained range-bound, individual stock performance was mixed, with 1,894 stocks rising and 3,268 stocks declining in the morning session. However, the number of stocks experiencing sharp declines was relatively low, suggesting the potential for further market movement in the afternoon.

5. Technology Stocks Continue to Lead

Sector-wise, technology stocks remained the strongest performers, led by software services, which rose 2.3%. Other sectors, including media and entertainment, mineral products, internet, and electronic components, also showed strength. On the other hand, the non-ferrous metals sector saw a slight decline of 1.38%, though it has still recorded a 6.95% gain so far this year, ranking seventh among 56 industry groups.

The Shanghai Composite Index tested its 60-day moving average again today, briefly breaking above it before retreating. Market sentiment appears to be turning more positive, with growing optimism among institutional investors. Additionally, while major policy support measures have yet to be introduced, expectations are building that they may be on the way.