Traditionally, it was said that American politics was influenced and dominated by the “military-industrial complex” – meaning that the United States’ geopolitics, foreign policy, and maintained international order reflected the interests of this complex. Trump’s political approach diverged dramatically from past practices, essentially abandoning the established model and reverting to an “isolationist” stance reminiscent of over a hundred years ago, focusing more on domestic concerns and avoiding military interventions in foreign affairs. The NATO alliance and regional military partnerships led by the US were also becoming unstable.

However, during Trump’s potential second White House term in 2024, a crucial new force emerged – what Biden termed the “tech-industrial complex” – where technology supersedes military power as the dominant force. The technological dimension joined the Trump/MAGA movement in a specific sequence: first Peter Thiel, then Elon Musk (representing the “tech right”), and finally Silicon Valley’s major corporations, entrepreneurs, and investors – from Zuckerberg and Bezos to Altman, Apple, and Google – who joined after Trump’s election.

These tech powers recognized that Trump fundamentally supports capital, deregulation, tax cuts, and mercantilism – allowing them to maximize their interests and shape America’s future under “Trump 2.0”. In this emerging order, the foundation shifts from military and defense to a global system powered by chips and artificial intelligence (with the understanding that these technologies can also have military applications).

Two recent US news stories illustrate this transformation, particularly regarding industry and investment within the tech-industrial complex.

On the second day of his White House tenure, Trump personally intervened to bring together Masayoshi Son (SoftBank), Larry Ellison (Oracle), and Sam Altman (OpenAI). These three announced the formation of a joint venture called “Stargate”, with a $500 billion investment aimed at building artificial intelligence infrastructure. Specifically, this primarily involves investing in data centers, with potential strategic investments along the AI ecosystem’s value chain, but the main focus remains data center infrastructure.

Recognizing this was a major investment project on Trump’s second day in office, he was extremely pleased, personally championing it and claiming the investment would create 100,000 jobs for the United States.

Can this be considered Trump’s achievement? Personally, while the AI trend has been ongoing for a couple of years and the Biden administration has been pushing industrial policies supporting key industries like semiconductors, the tech and industrial sectors still perceive the Biden/Democratic administration as overly regulatory and less friendly to businesses, capital, and technological innovation. If interviewed, most industry players would likely believe these industries would receive greater encouragement and development under a Trump administration.

At least in expectations, they believe a “golden age” has arrived.

For investment and entrepreneurship, expectations are crucial. Optimistic expectations motivate people to take more risks and be more willing to invest and start businesses.

Regardless of the US economic trajectory in the next one or two years, whether inflation can be controlled, or if manufacturing will truly return, for Silicon Valley entrepreneurs and investors in the new economy, the atmosphere has been set. People are indeed in a state of vibrant energy, eager to make significant moves. Undoubtedly, “Stargate” will intensify competitive pressures for all competitors, including Chinese entrepreneurs and businesses.

In this scenario, all parties emerge as winners. In fierce competition, OpenAI+Oracle welcome funding. SoftBank wants to ride the trend, repair relationships with investors, and prove itself again through the AI wave. Investors, despite being shrewd and visionary, also have a gambler’s side. So, they’re all in on AI, launching satellites as big as possible. Conveniently, Son has some connection with Trump and can leverage it. (During Trump’s first term, Son also launched a satellite by impulsively investing in WeWork).

As for Trump, he’s both a politician and the top investment attraction officer. He needs achievements, visual effects (“presence”), publicity, and demonstration. Thus, he’s naturally thrilled about “Stargate”. Especially since he recently discussed with Son investing $100-200 billion, giving this project a sense of immediate closure. However, what Trump values most isn’t the investment amount itself, but employment. He claims this will create 100,000 jobs (a number that can never be verified, nor needs to be).

The Japanese might feel somewhat conflicted. They see SoftBank still thriving in the US, leveraging American tech giants to invest in and build AI infrastructure and industrial chain positioning. Yet, a similar scenario is difficult to replicate in Japan—at least not at a comparable scale. Japan might believe it’s performing well in US-Japan alliance relations, but Trump won’t prioritize Japan—he’ll personally work to attract Japanese capital, industrial, and talent resources to the United States. This is an era of great power competition on geopolitical and economic foundations. Every country must determine whether they’re at the table or on the menu.

Of course, this job creation narrative has some issues, primarily because in an era where human technology is approaching Artificial General Intelligence (AGI) and Artificial Superintelligence (ASI), the relationship between AI and human labor is complex. It’s no longer simply about “new technology creating more jobs”, but about AI reconfiguring labor relations and productivity, potentially displacing or replacing human labor and pushing most workers to the lowest-value chain segments.

Regarding the investment by Softbank, OpenAI, and Oracle

- Data centers themselves do not create many job opportunities, whether during the brief construction phase or in the operational stage, which requires minimal staffing.

- While these data centers serve AI companies and may indirectly support the AI industry, several critical points emerge:

- First, the AI industry is capital and technology-intensive, not labor-intensive. It will not generate significant employment in absolute numbers.

- Second, the AI industry primarily requires high-end talent – highly educated elite engineers and technical specialists. This connects to the ongoing H-1B visa controversy in the United States, where: (1) Tech leaders like Musk advocate for more immigrant talent; (2) Trump’s base opposes this, viewing it as contrary to “America First” principles. This debate has created deep political divisions, with Vivek Ramaswamy’s recent political ousting being a notable example.

- Third, AI’s ultimate goal is developing artificial general intelligence (AGI) or superintelligence that will eventually replace most human labor, except for a few elite managers. Metaphorically, even the construction workers building these data centers are essentially helping to create the AI systems that will ultimately replace human workers. A poignant example is how autonomous driving companies hire human drivers to train AI, effectively teaching the technology that will eventually render those same workers unemployed. The underlying narrative suggests a transformative technological shift where AI progressively eliminates human labor across various sectors.

Therefore, this plan has no relevance to Trump’s MAGA base—white working-class individuals with high school or lower education—in the short, medium, or long term, and may even harm their interests. The primary beneficiaries are technology companies and capital.

It’s important to note that we’re examining this from a broader perspective of human society and historical trends in the 2020s, not making political criticism or value judgments. Artificial intelligence replacing human labor appears to be an inevitable future trend. If most people become unemployed due to AI, what solutions remain?

Therefore, government intervention becomes crucial. Potential strategies might include:

- Creating employment opportunities

- Implementing universal basic income

So a bold assertion emerges:

- Future technology + capitalism = dystopia

- Future technology + socialism = utopia

Similarly, an argument that “only socialism can save” a country (I’m not going to address which country) might stands from this perspective.

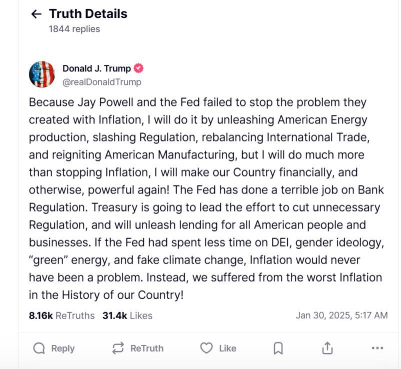

Trump issued an executive order to dismantle Diversity, Equity, and Inclusion (DEI) offices across federal government departments. The order mandates that DEI personnel begin paid leave by 5 PM Eastern Time on Wednesday and will subsequently be terminated. Additionally, agencies must shut down all DEI-related websites and social media accounts by the deadline.

DEI essentially provides special considerations and quotas for diverse and marginalized groups, including women, transgender individuals, and people of color, particularly in hiring, salary, and promotion processes. This is a core agenda of left-wing liberalism.

However, many argue that DEI has become excessive, potentially compromising fairness and efficiency. Critics contend that individuals might be hired based on gender, sexual orientation, or skin color rather than merit, which could be seen as a form of discrimination against more qualified candidates.

Educated metropolitan elites exposed to liberal ideologies tend to understand DEI’s principles, though they may not always agree with specific implementations. For many ordinary Americans, DEI represents a symptom of left-wing ideology and is viewed as a sign of social decay, with some even suggesting it’s part of a broader conspiracy to marginalize white populations.

Elon Musk’s “Department of Government Efficiency” (DOGE) aims to streamline government operations by reducing expenses, eliminating redundant regulations, simplifying structures, and optimizing processes. In practice, this often translates to workforce reduction.

From a corporate perspective, such efficiency drives are crucial. Reducing costs and increasing efficiency directly correlates with maximizing profits. Employees are seen primarily as tools for profit generation, and those perceived as surplus may be viewed as obstacles to financial performance.

The current global competitive landscape, compounded by artificial intelligence and automation, provides strong incentives for businesses to optimize workforce structures, potentially including replacing human labor with AI solutions.

Musk and his Silicon Valley peers are essentially applying corporate management strategies to reimagine federal government operations.

The DOGE on X platform gleefully announced the dissolution of the Diversity Officers Executive Council, noting that its webpage has been taken down. Elon Musk also enthusiastically reposted and commented, viewing the elimination as a DOGE achievement.

This council was a cross-agency federal government organization responsible for implementing and maintaining nationwide Diversity, Equity, Inclusion, and Accessibility (DEIA) strategies. Most federal DEI programs were created through Biden administration executive orders, making them an easy target for Trump, conservatives, and DOGE to dismantle.

It’s unclear whether Musk’s DOGE was directly involved in drafting the related executive order. However, it’s evident that DEI was already a prime target for elimination by Trump-aligned and mainstream Republican forces, with or without DOGE’s involvement.

In the United States, Diversity, Equity, and Inclusion (DEI) has been a significant direction and specialized field within human resources, even considered a critical component of corporate strategy. There are now MBA programs specifically focused on DEI. However, the current trend is shifting, with the federal government leading efforts to dismantle DEI initiatives, which is likely to influence local governments and private sectors to follow suit.

Consequently, professionals working in DEI should be concerned about job security in the coming years. A related field is “ESG” (Environmental, Social, and Governance), which is a Western-developed framework for assessing a company’s sustainability and ethical impact. The decline of DEI could have significant implications for ESG.

The government’s efficiency initiatives are not solely targeting DEI—they aim to dramatically reduce personnel across the federal government system, regardless of department or function—similar to Elon Musk’s approach when he acquired Twitter. Ultimately, Musk demonstrated that fewer people could accomplish the same or even more work.

In the ongoing technological evolution, the latest tech tools—from digitalization to artificial intelligence—will be powerful enablers. They can effectively improve human productivity and reduce the workforce needed to complete equivalent tasks. Artificial intelligence is precisely what pioneers like Masayoshi Son, Larry Ellison, Sam Altman, and other AI competitors are dedicated to pursuing.

Corporations fundamentally seek profit and capital return maximization, viewing personnel merely as a production factor. However, governments and private enterprises differ significantly. Public sectors must satisfy public interests, meet collective needs, and achieve broader societal goals. Labor efficiency is not just the primary objective of the public sector—it may not even be an objective at all.

While no one can accurately predict how far we are from artificial general intelligence (AGI) or superintelligence, or even provide universally accepted definitions, one undisputed fact remains: AI’s emergence will accelerate the potential replacement of human labor.

During this transition, profit-driven capitalists and businesses will undoubtedly embrace AI applications, substantially reducing human staff across various roles—from customer service and sales to middle management. As technological replacement expands, even low and medium-skilled jobs like drivers, delivery workers, service staff, and retail employees will be at risk.

Addressing potential widespread unemployment requires governmental intervention. Governments have two primary strategies:

- Direct Income Provision: Implement universal basic income through tax and fiscal transfer mechanisms, redistributing profits generated by capital and technology to ordinary citizens.

- Job Creation: Generate employment opportunities specifically to provide meaningful work. If private sectors cannot employ people, the government becomes the employer. Recognizing that humans are social beings who need purpose, community, and dignity, providing work that offers belonging and self-worth becomes crucial.

Ultimately, whether through income support or employment, the fundamental goal is ensuring social and political stability in an increasingly technology-driven landscape.

Lastly

In examining two recent news, what we’re seeing in the US is a new political-economic model pushed forward by middle and lower-class white voters: a “Technology-Industrial Complex” combined with conservative/right-wing economic principles.

Key characteristics include:

- A foundational framework of free-market capitalism with small government, low taxes, and minimal welfare

- Staunch opposition to socialism and left-wing economic theories

- Technology companies and tech capital emerging as dominant forces, closely intertwined with political power and creating oligarchic and crony political structures

These tech enterprises not only directly influence government regulation of technological industries but can also potentially orchestrate large-scale downsizing and restructuring of government and public sector institutions.

This “Technology-Industrial Complex” paired with conservative economic ideology will likely lead to a “dystopian” future. While one potential outcome is social solidarity leading to revolutionary change, another bleak scenario suggests ordinary people might be reduced to surviving on minimal government subsidies while retreating into the metaverse, seeking meaning and value in virtual worlds.