Last night, four major events caught global attention, with one standing out: the impressive surge of Chinese stocks listed in the U.S. While the broader U.S. stock market remained volatile, Chinese stocks saw a strong rally.

1. Chinese Stocks Surged—Fueled by AI Developments

The rally was largely driven by the growing influence of DeepSeek, a rising AI player, and Alibaba’s latest AI model. Yesterday, Alibaba announced the open-source release of Qwen2.5-Max, an AI model reportedly on par with GPT-3.5. This move reinforced China’s competitive edge in developing high-performance AI at lower costs, prompting global investors to reassess Chinese tech stocks.

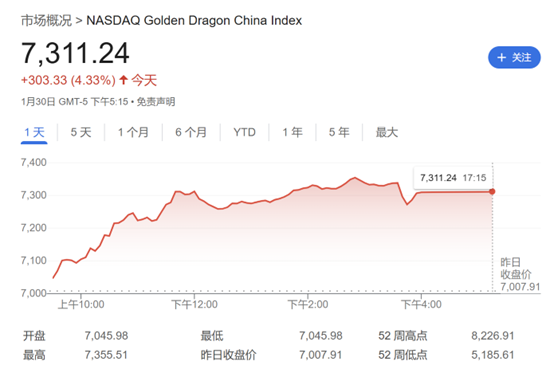

The numbers speak for themselves:

- The Nasdaq Golden Dragon China Index, which tracks Chinese stocks listed in the U.S., rose 4.33%.

- Alibaba jumped 6.22%.

- The China Internet ETF saw $105 million in net inflows, the highest since October 2023.

With markets reopening after the Lunar New Year, investors may want to keep an eye on Chinese AI and tech stocks, especially those focused on AI applications.

2. U.S. Tariff Threats—Trump’s Plan to Tax Canada and Mexico

U.S. President Donald Trump announced plans to impose a 25% tariff on imports from Canada and Mexico starting February 1 (tomorrow!). If implemented, this could have several effects on global markets:

- Positive for U.S. Stocks: Higher tariffs make American-made products more competitive.

- Stronger U.S. Dollar: Past tariff hikes have triggered capital inflows to the U.S.; after the 2018 China tariffs, the U.S. Dollar Index climbed 4.1%.

- Market Uncertainty: Trade tensions often push investors toward safe-haven assets like the US dollar.

- Potential Fed Response: If tariffs drive inflation higher, the Federal Reserve may consider interest rate hikes, further strengthening the dollar.

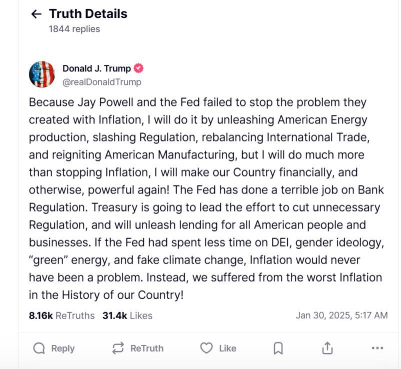

3. Trump Criticizes the Federal Reserve Over Interest Rates

Shortly after the Federal Reserve decided to keep interest rates unchanged, U.S. President Donald Trump took to social media to directly blame Fed Chairman Jerome Powell for mismanaging inflation. Trump has a history of criticizing Powell—during his previous term eight years ago, he would call him out almost every ten days for not cutting interest rates.

Trump’s reasoning is simple: lowering interest rates would weaken the U.S. dollar, making American exports more competitive, boosting employment, and driving up the stock market—all of which could increase his political support.

4. Rising Uncertainty Boosts Gold Prices

Market uncertainty is pushing investors toward safe-haven assets like gold. The possibility of new tariffs on major trading partners could lead to trade tensions, while ongoing geopolitical conflicts add to economic unpredictability. In response, central banks worldwide are increasing their gold reserves, making a continued rise in gold prices highly likely.

Currently, gold is trading at around $2,800 per ounce, not far from Goldman Sachs’ target of $2,910. With gold prices up 8% this year and silver surging nearly 12%, the bullish trend is expected to continue.